39 share buyback meaning

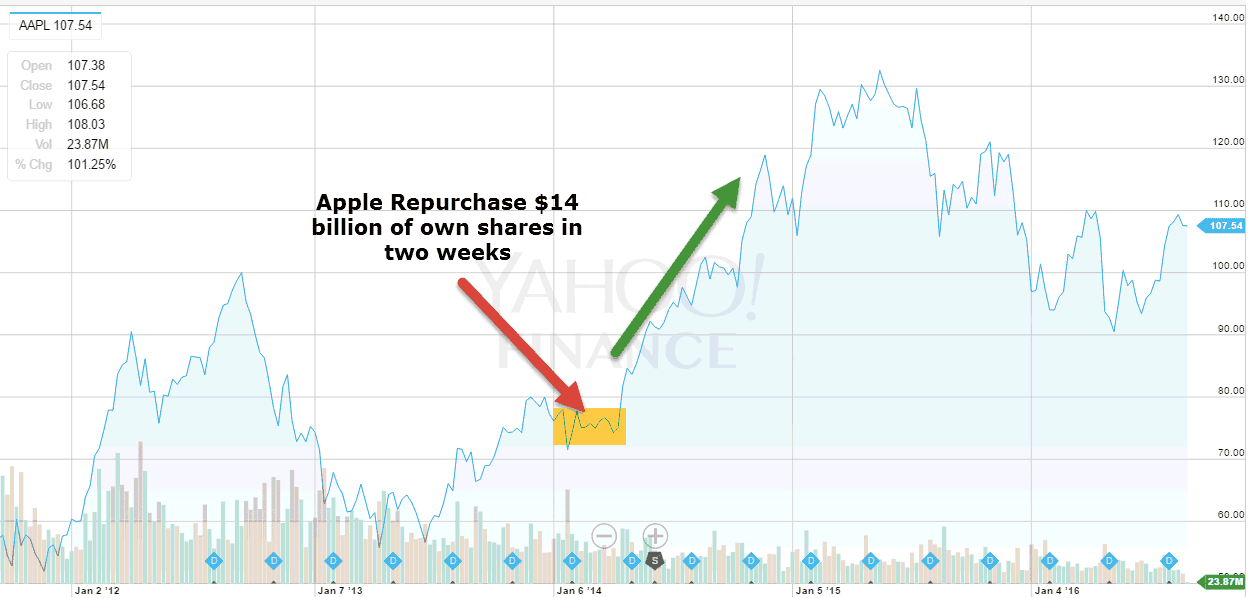

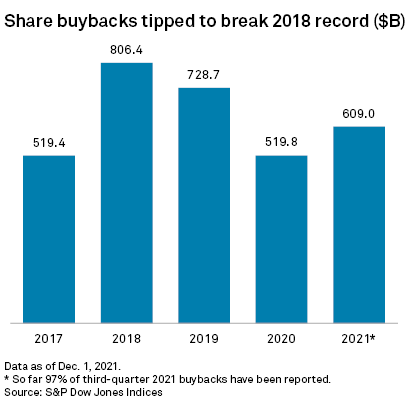

What is a Stock Buyback? Definition & Benefits of Share ... 12/01/2022 · A stock buyback will often follow a successful period, meaning the company will have to buy its own stock at a higher valuation. For investors though, it can be tricky to suss out whether a company’s decision to repurchase shares is a sound one or one motivated by manipulating financial metrics and therefore ultimately misleading. 60 second guide: Share buybacks - CommBank Share buyback explained. A buyback is when a company offers to re-purchase some of its shares from existing shareholders. The net effect is a reduction in the total number of a company's shares on issue. This is generally seen as a way for companies to boost shareholder returns because after the buyback a company's profit will be spread ...

SHARE | meaning in the Cambridge English Dictionary share definition: 1. to have or use something at the same time as someone else: 2. to divide food, money, goods…. Learn more.

Share buyback meaning

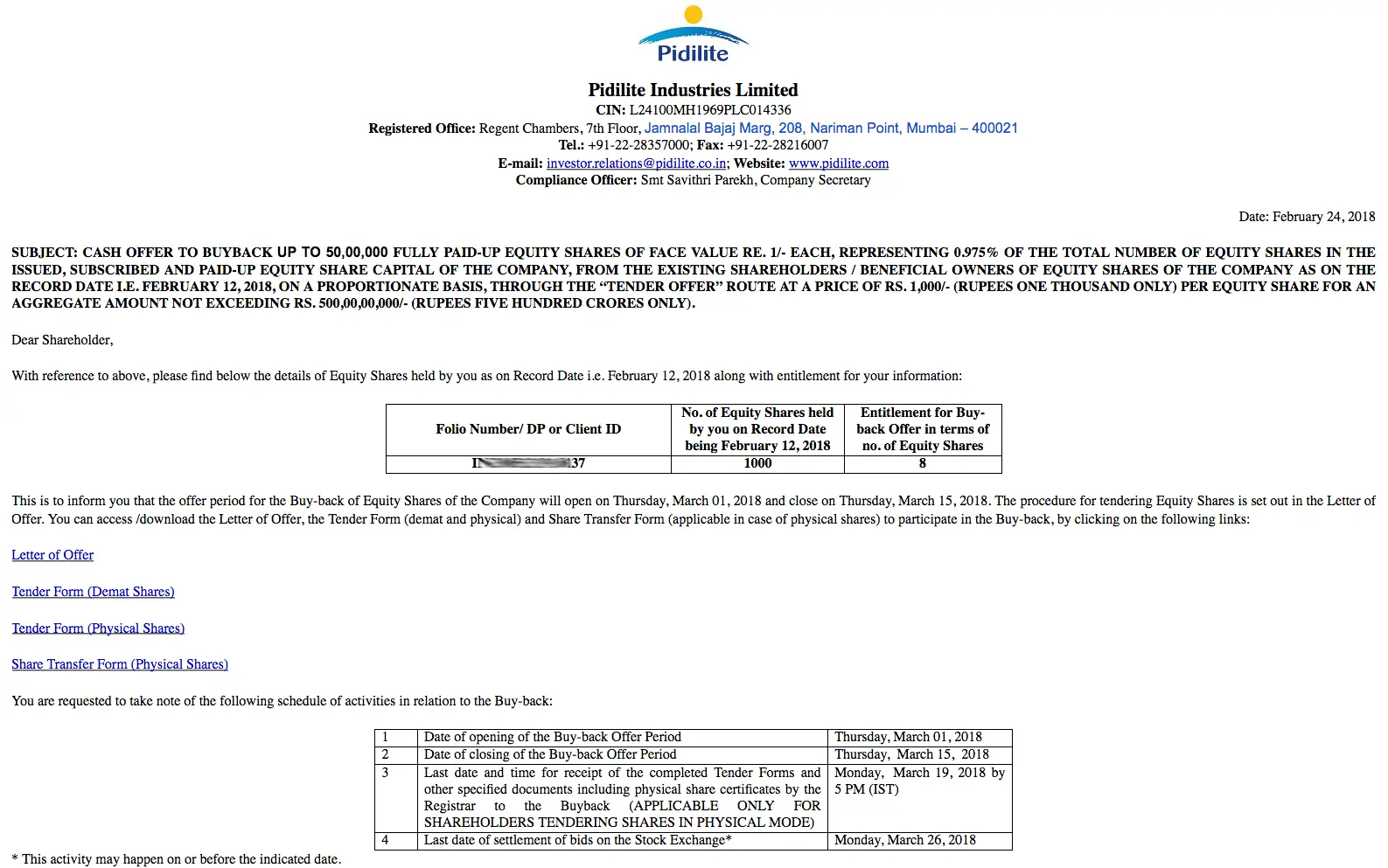

Share repurchase - Wikipedia Share repurchase (or share buyback or stock buyback) is the re-acquisition by a company of its own shares. It represents an alternate and more flexible way (relative to dividends) of returning money to shareholders.. In most countries, a corporation can repurchase its own stock by distributing cash to existing shareholders in exchange for a fraction of the company's outstanding equity; that is ... Share Buyback | Reasons of Share Buyback | Share ... - EDUCBA Definition of Share Buyback. When there is a large number of shares available in the capital market or open market, the company tries to buy back (purchase) its own shares from the open market for reducing the number of shares available to other shareholders so that the external shareholders should not be able to buy those shares and take the controlling interest in the company and this ... Buyback of Shares Meaning - Ways, Participation, Pros & Cons Rule 1- The way shares are bought in the demat account is the same way the buyback of the share is done through a demat account. The buyback option will flash on the screen. Rule 2- investor needs to check the offer price and also for how many days the buyback offer is valid as during this time only the company will repurchase the shares.

Share buyback meaning. Buyback 2022: Upcoming & Latest Share Buyback Offers with ... 22/03/2022 · What is Share Buyback Meaning? Stock buyback means publicly traded companies buying back their own shares from the shareholders. Company funds their buyback with surplus cash. A buyback is also known as repurchase is purchased by the company of its outstanding shares that decreases the number of shares in the open market. Buyback of Shares Meaning, Procedure and Taxation Explained Buyback of shares meaning A buyback of shares is buying back of own shares by a company that was issued earlier. It is a corporate action event wherein a company makes a public announcement for the buyback offer to acquire the shares from existing shareholders within a given timeframe. Stock Buybacks: Why Do Companies Buy Back Shares? A buyback is a repurchase of outstanding shares by a company to reduce the number of shares on the market and increase the value of remaining shares. more Treasury Stock (Treasury Shares) Buyback of Shares - Meaning, Reasons, Methods and ... Buyback of shares leads to an increase in the earnings per share ratio of a company as the dividend is divided among fewer shareholders. This makes the financial statement more attractive for investors. Furthermore, a company with a scheduled buyback draws the attention of short-term investors too.

TCS' Rs 18,000 crore buyback offer subscribed 7.5 times Mumbai: The ₹18,000-crore share buyback of India's largest software exporter Tata Consultancy Services was subscribed more than 7.5 times on Wednesday - the last day for tendering of shares. Investors offered 30.12 crore shares in the buyback process, which started on March 9, against the company's offer of four crore shares. What is a share buyback? | Share repurchase definition Share buyback definition What is share buyback? Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future. What is BuyBack of Shares? | Why Companies Buy Back Their ... BuyBack of shares is a concept when a company buys back its own shares from the existing shareholders, to reduce the number of shares available in the open m... Buyback Definition & Meaning - Merriam-Webster The meaning of BUYBACK is the act or an instance of buying something back; especially : the repurchase by a corporation of shares of its own common stock usually on the open market. How to use buyback in a sentence.

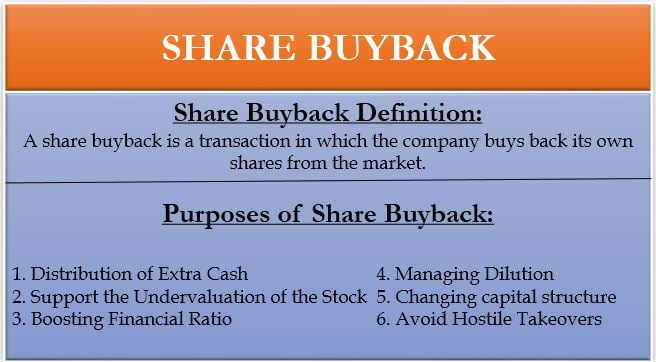

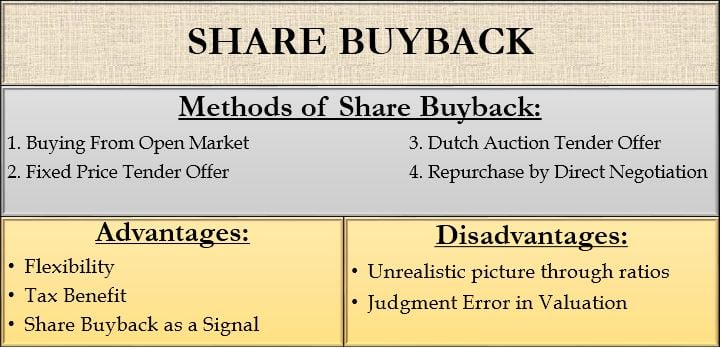

Share Buyback | Definition, Example, Methods, Purposes A share buyback is a transaction in which a company buys back its own shares from the open market. Another term for it is share repurchase. There are various methods to buyback shares. The company can buy back the shares from the market or tender offer. The shares bought back will be reclassified as treasury shares or it will be canceled ... What Is Buyback of Shares - Meaning, Process, Reasons and ... For the longest time, the concept of share buy back remained buried under the Companies Act, 1956. It was the amendments to Sections 68, 69, and 70 of this Act that redefined and systematically put out the share buyback meaning and process. GE Surges on Plans for $3 Billion Share Buyback ... 09/03/2022 · Investing.com – General Electric (NYSE: GE ) stock gained 3.1% in premarket trading Wednesday after the company said it will buy back shares for up to $3 billion. Repurchases will be made from time to time in the open market, the company said without specifying an expiration date for the exercise ... Share Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It's simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common ...

Buyback Definition Mar 10, 2022 · A buyback is when a corporation purchases its own shares in the stock market. A repurchase reduces the number of shares outstanding, thereby inflating (positive) earnings per share and, often, the...

SHARE BUYBACK | meaning in the Cambridge English Dictionary share buyback definition: an offer by a company to buy shares of its own stock from shareholders: . Learn more.

What Is A Share Buyback? Definition, Meaning & Basics Of ... Share Buyback: Definition, Meaning & Basics. Shares issued by a company are bought and sold either on the stock market or over the counter. A company, at certain times, can also decide to purchase its own shares, via a process called share buyback. Once bought back the shares are to be extinguished and hence lead to a reduction in the share ...

Share buyback - what this is and what a company needs to do A buyback of shares is where the company buys some of its own shares from existing shareholders. There are three types of share buyback: Purchase of own shares. Share redemption. Share capital reduction by: cancelling shares. repaying share capital. reducing the nominal value of a share class.

What Is A Stock Buyback? - Forbes Advisor The main goal of any share repurchase program is to deliver a higher share price. The board may feel that the company's shares are undervalued, making it a good time to buy them.

Share Repurchase - Overview, Impact, and Signaling Effect A share repurchase refers to when the management of a public company decides to buy back company shares that were previously sold to the public. A company may decide to repurchase its sharesto send a market signal that its stock price is likely to increase, to inflate financial metrics denominated by the number of shares outstanding (e.g., earnings per share or EPS), or simply because it wants ...

What is a share buyback? | Share repurchase definition | IG SG Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future.

M&G PLC unveils £500mln share buyback programme after ... 08/03/2022 · M&G unveils £500mln share buyback programme after robust performance ... The company announced a second interim dividend of 12.2p, meaning the company will have paid 52p in dividends since 2019.

Share buyback financial definition of share buyback Buyback The act of a publicly-traded company buying its own stock, sometimes at a price well above fair market value. Buyback is not intended to stop trade on its stock. Rather, it is an attempt either to reduce the supply of shares in the market (with the hope of driving up the share price) or to prevent a real or suspected hostile takeover. If a ...

Share Buyback (Definition, Examples) | Top 3 Methods Share buyback refers to the repurchase of the company's own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company's balance sheet thereby raising the worth of remaining outstanding shares or to block the control of various shareholders on the company.

Share Buyback - Advantages, Disadvantages, and How Does It ... Share buyback The share buyback is when companies buy back their own shares from the shareholders. There are multiple logics and methods that why the companies opt for buying back. However, shareholder's approval is required for the successful execution of the transaction. The methods and reasons for the implementation of the buyback program have been … Share Buyback - Advantages ...

Share Repurchase Definition - investopedia.com 15/12/2021 · A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the ...

Share Buybacks: What It Means And How It Impacts Investors Definition of 'Share Buyback'. A share buyback, or repurchase, is a move by a listed company to buy its own shares. This can be from the open market, issuing a tender offer, or arranging for a private buyback from a shareholder (s). Share buybacks are a corporate action that require companies to make a public filing with regulators.

Buyback of Shares Meaning - Ways, Participation, Pros & Cons Rule 1- The way shares are bought in the demat account is the same way the buyback of the share is done through a demat account. The buyback option will flash on the screen. Rule 2- investor needs to check the offer price and also for how many days the buyback offer is valid as during this time only the company will repurchase the shares.

Share Buyback | Reasons of Share Buyback | Share ... - EDUCBA Definition of Share Buyback. When there is a large number of shares available in the capital market or open market, the company tries to buy back (purchase) its own shares from the open market for reducing the number of shares available to other shareholders so that the external shareholders should not be able to buy those shares and take the controlling interest in the company and this ...

Share repurchase - Wikipedia Share repurchase (or share buyback or stock buyback) is the re-acquisition by a company of its own shares. It represents an alternate and more flexible way (relative to dividends) of returning money to shareholders.. In most countries, a corporation can repurchase its own stock by distributing cash to existing shareholders in exchange for a fraction of the company's outstanding equity; that is ...

:max_bytes(150000):strip_icc()/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

0 Response to "39 share buyback meaning"

Post a Comment